How ACA Works

Time for loan processing to evolve

How ACA Works

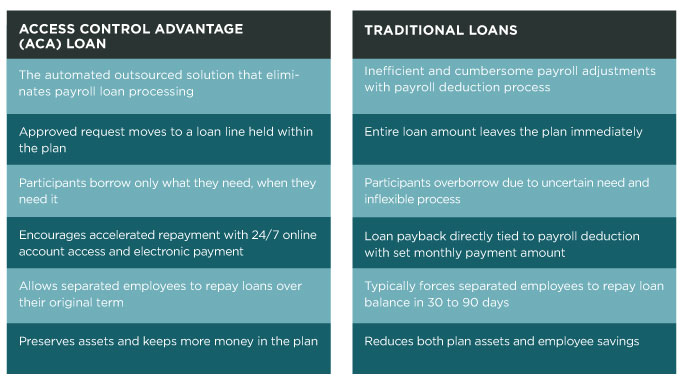

Funds from the loan line are available when needed and unused amounts are easily returned to core investments at any time.

Loans are repaid directly to an ACA service provider and are independent of payroll deduction; therefore, the loans can survive the employee/employer relationship. Employees who separate from their employer can repay their ACA loan over the remaining original term of the loan, versus traditional loans that typically require full repayment in 30 to 90 days. This feature can eliminate a deemed distribution if an employee loses a job or changes jobs. Taxes and penalties after an employee leaves a job can be avoided; in addition, ACA can significantly reduce the incidence of loan defaults and leakage.

This approach means reduced costs and fewer administrative responsibilities for both the Recordkeeper and Plan Sponsor. Recordkeepers, like 401k Recordkeepers for example, may also earn higher revenue based on increased asset retention. The Plan Sponsor eliminates payroll deduction and maintenance responsibility. For the Plan Participant, like those who borrow from a 401k, ACA helps reduce borrowing, increases retirement savings and enables Plan Participants, including those who are no longer active employees, to continue making loan repayments.

It’s Easy To See ACA’s Advantages

Bob Wuelfing, President

860.402.4234